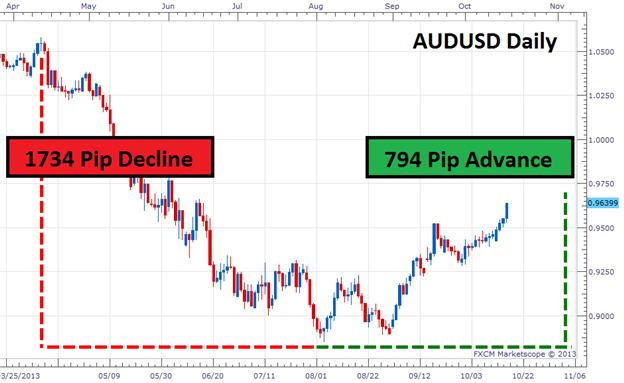

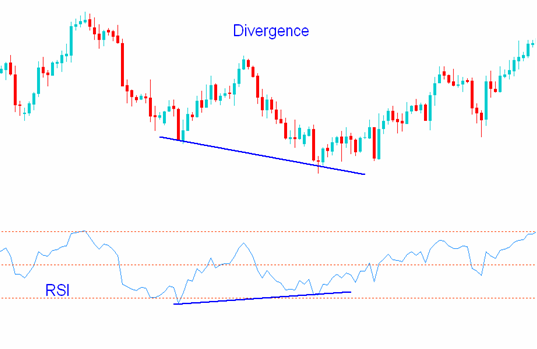

Okay, let's begin by asking the most obvious question. We'll explore what RSI Divergence really is and what trading signals we can learn from it. A divergence is when the price movement is not aligned with the RSI indicator. This means that in an economy that is in a downtrend where the price action creates a lower low, and the RSI indicator makes lower lows. A divergence is essentially when the indicator does not match the price movement and when a situation similar to occurs, it is important to pay attention to the market. Based on the chart it appears that both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are apparent. However, the price action actually reversed following both RSI divergence signals. Let's discuss one last topic before move to the thrilling topic. Read the recommended trading platform for blog examples including best trading platform, best forex trading platform, online trading platform, automated trading platform, automated cryptocurrency trading, trading platform, best crypto trading platform, cryptocurrency trading, automated trading bot, backtesting strategies and more.

How Do You Analyze Rsi Divergence?

We use the RSI indicator to spot trends that are reversing. It is crucial to determine the correct trend reversal. In the beginning, we must have an uptrending market. Then , we can utilize RSI divergence to find weak points. Once that information has been identified and analyzed, we can use it to spot the trend reversal.

How To Spot Rsi Divergence When Trading Forex

Both Price Action and RSI both reached higher highs during the first uptrend. This typically indicates that the trend appears to be strong. At the end of the trend, prices reach higher highs, and the RSI indicator forms lower highs. This means that there are things to be watching within this chart. This is when we need be watching the market as the indicator as well as the price action are out of sync. It indicates that there is an RSI deviation. In this example this case, the RSI divergence indicates an upward trend. Take a look above at the chart to see the changes that took place following the RSI diversification. It is evident that the RSI Divergence is extremely specific in identifying trends reversals. However, the issue is: how do you actually detect the trend reversal, right? Let's look at four practical trade entry techniques that give higher-risk entry signals when combined with RSI divergence. Follow the top rated backtester for site recommendations including backtesting platform, trading platform crypto, forex trading, forex backtesting software, trading with divergence, RSI divergence, forex tester, software for automated trading, trading with divergence, backtesting trading strategies and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

There are two types of chart pattern that are triangles. The first is the Ascending Triangle pattern, which is used in the downtrend as a reverse pattern. The pattern of the descending triangle is used to reverse the trend of a market when it is in an upward trend. Let's look closer at the chart of forex to see the downward circle pattern. Similar to the example previously mentioned it started out in an uptrend before the price fell. RSI however, indicates the divergence. These clues indicate the negatives of this trend. The current price shows that the momentum of the ongoing uptrend has decreased and the price was capped in a triangular pattern that descending. This is proof of the reverse. It's now time for short-term trading. Like the trade we did before, we used the same breakout techniques for this trade. Now let's move to the third trade entry method. This time, we'll combine trend structure with RSI diversgence. Let's examine how to trade RSI divergence in the event that the trend is changing. Have a look at the most popular backtesting trading strategies for website info including crypto trading bot, divergence trading forex, divergence trading forex, crypto trading backtesting, crypto trading backtester, software for automated trading, software for automated trading, backtesting tool, automated cryptocurrency trading, backtesting trading strategies and more.

Tip #2 – Combining RSI Divergence Pattern with the Head & Shoulders Pattern

RSI Divergence can help forex traders identify market reverses. It is possible to boost the probability of trading by using RSI diversence with other reversal factors, such as the head or shoulders pattern. Now let's see how to timing our trades by using RSI divergence with the head and shoulder pattern. Related: How to Trade the Head and Shoulders Pattern in Forex - A Reversal Trading Method. Before we can think about trade entry, it is essential to enjoy a positive market situation. A trending market is preferable because we're trying to discover an opportunity to reverse the trend. Take a look at the chart below. Take a look at recommended divergence trading forex for blog examples including backtesting tool, divergence trading forex, backtester, automated forex trading, software for automated trading, stop loss, divergence trading forex, backtester, forex tester, automated trading platform and more.

Tip #3 – Combining RSI divergence and the trend structure

The trend is our best friend. We must trade in the direction of trend for as long as the market is trending. This is the way professionals instruct us. Trends don't last forever. It is likely to change. So let's try to identify those reversals in early times by studying trend structure and RSI Divergence. We know that the trend is making higher highs, whereas the downtrend has lower lows. This chart illustrates this point. It is a downward trend with a lower series of lows and higher highs. Next, let's take a glance (Red Line) at the RSI divergence. It's true that price action makes lows, while the RSI creates lower lows. What is this indicating? While the market is creating low RSI it's doing exactly the opposite. This suggests that the current downtrend could be losing momentum. Have a look at the recommended trading divergences for website examples including crypto backtesting, crypto trading backtester, backtesting strategies, best trading platform, divergence trading, cryptocurrency trading, stop loss, backtesting strategies, trading platform cryptocurrency, best trading platform and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom Double Bottom

Double-bottom or double-top is a reverse chart that forms after a long move or an upward trend. Double tops are formed when the price reaches an unbreakable threshold. After hitting that level, the price will retrace down a bit, only to return back to test the previous threshold. A DOUBLE TOP happens when the price bounces off this threshold. Take a look at the double top below. The double top above shows that the two tops formed following a powerful move. Notice how the second top is unable to break above the first top. This is a strong indicator that a reversal could occur because it tells the buyers that they are struggling to continue going higher. Double bottoms employ the same principles, but in a different method. We employ the breakout trading strategy. In this example we will sell the trade once the price drops below the trigger line. The price broke below the trigger line and we executed a sell trade within one day. QUICK PROFIT. The same techniques for trading can be used for double bottom too. Below is a chart which will show you the best way you can trade RSI diversgence when using the double top.

It's not the best trading strategy. There is no "perfect" trading method. Every trading strategy has losses. We can earn consistent profits using this strategy, but, we do have a strict risk management method and a fast way to limit our losses. This allows us to cut down on drawdowns and opens the doors to huge upside potential.